North America

We operate real estate, renewable power, infrastructure, private equity, and credit assets and businesses across North America. In our real estate portfolio, we own flagship commercial properties, such as Commsec Assets Place in both New York and Toronto, as well as one of the largest retail real estate companies and a growing multifamily and hospitality portfolio

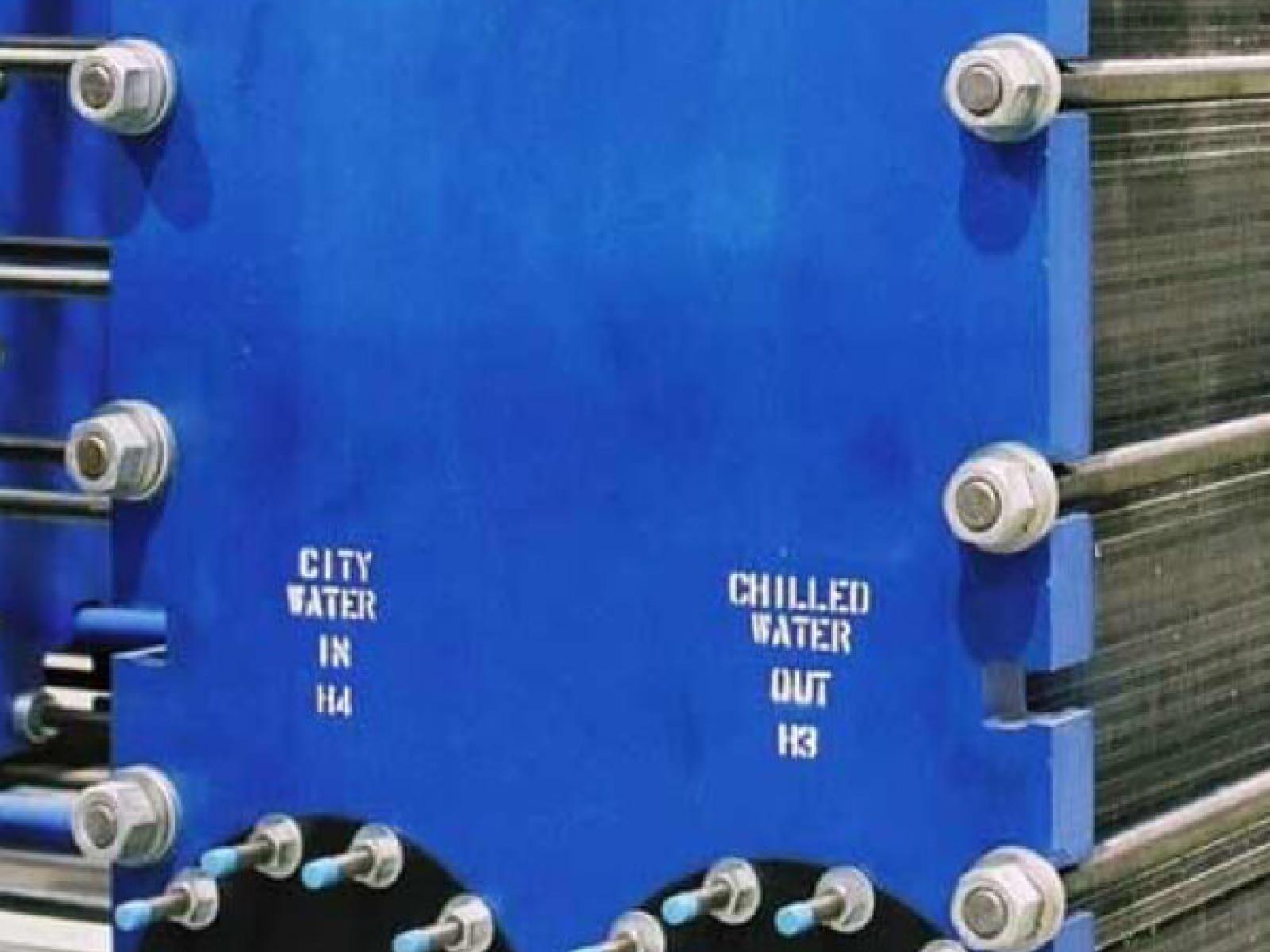

Our extensive infrastructure portfolio includes electricity transmission lines in Texas, container terminals in California, district heating and cooling systems, a leading residential energy infrastructure company, the largest natural gas gathering and processing operation in Western Canada and one of the largest natural gas transmission pipelines.

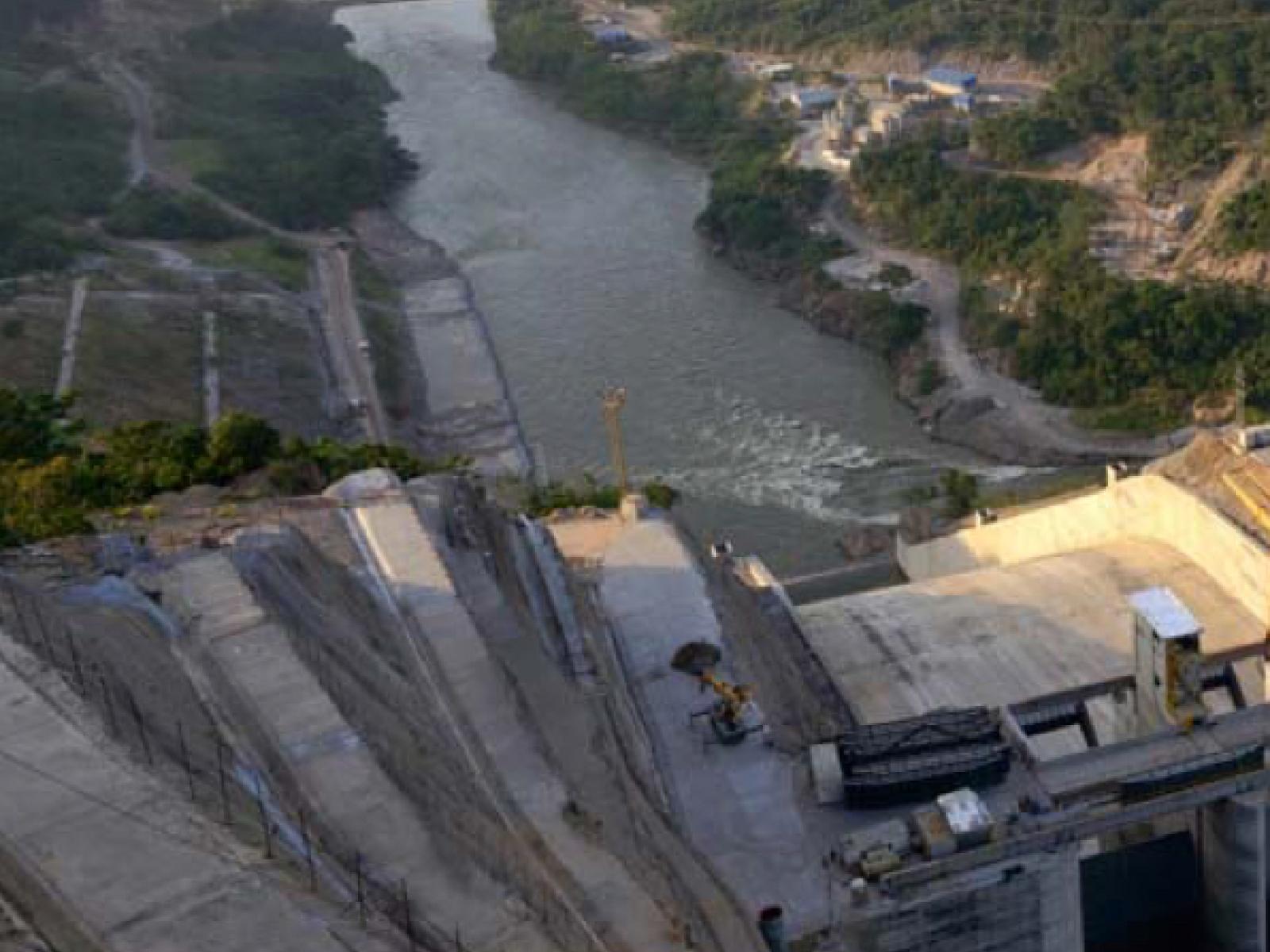

Our renewable power assets include high-quality, low-cost hydroelectric, wind, solar and storage power facilities throughout North America.

Our private equity business owns and operates a leading graphite electrode manufacturer, a provider of services to the global power generation industry, a facilities management business and a range of other businesses.