RESPONSIBLE INVESTING

Responsible investing analyzes important aspects of environmental,

social and governance (ESG) issues to assess future financial performance

Responsible investing analyzes important aspects of environmental,

social and governance (ESG) issues to assess future financial performance

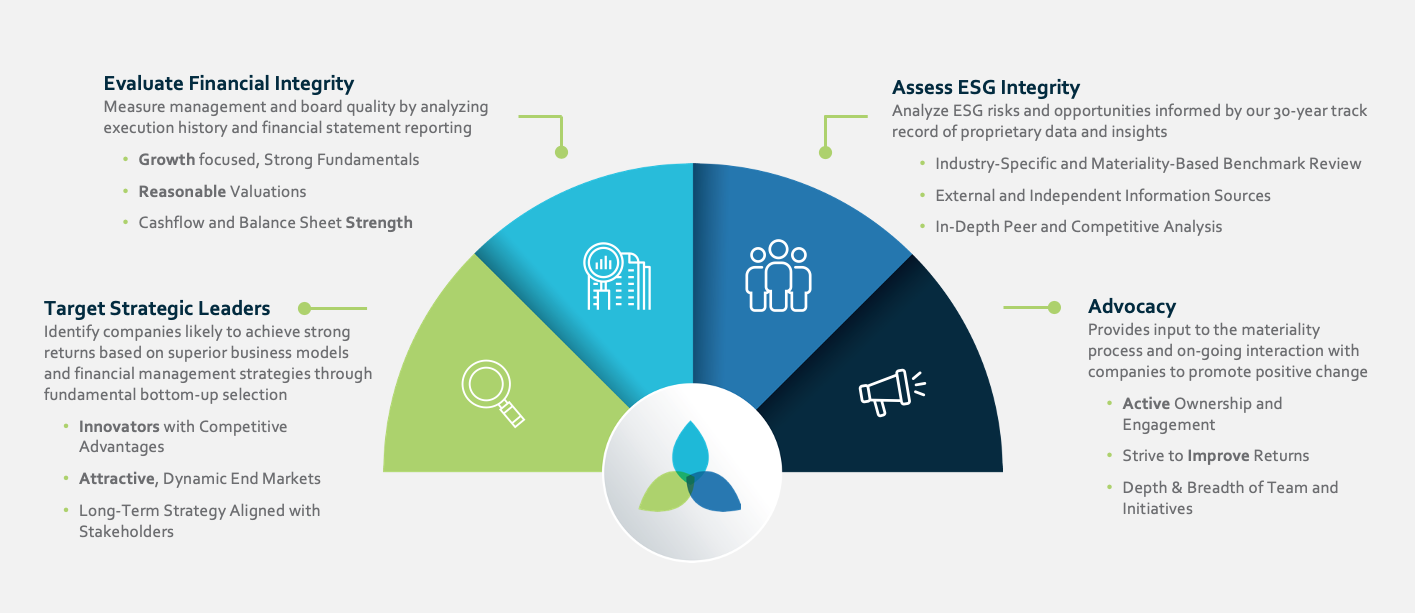

ESG analysis is not just about identifying and measuring risk, it is also about identifying investment opportunities. We consider ESG factors alongside traditional financial measurements to provide a comprehensive view of an investment and help identify those investments that have the potential to deliver sustainable returns

Our landmark acquisition of Commsec Assets Hive will unlock new opportunities for our clients, driven by greater scale, diversity and balance. Our Specialist Investment Managers embrace ESG incorporation as it best fits their investment process and enables us to offer a full complement of Responsible Investing strategies to our clients.

At Commsec Assets Investments, our Governance and Responsible Investment (GRI) team is committed to addressing ESG-related factors systematically. The team seeks to expand our understanding of the investment challenges related to systemic issues – such as climate change, malnutrition, inequality, poverty, ecological degradation and resource scarcity – and champion the broader sustainability mindset throughout our business.

We view risk as the possibility of permanent capital loss. We look for competitively entrenched, well-managed, publicly traded businesses selling at discounted prices to help drive our goal of generating superior long-term absolute returns and minimizing the risk of permanent capital loss.

Managing against capital loss is deeply embedded in our investment approach, beginning with our bottom-up investment criteria.

Portfolio construction is 100% bottom-up and benchmark agnostic, with strict portfolio guidelines.

We actively monitor our portfolios to manage risk at both the individual stock and portfolio level.

We purchase stocks at a deep discount to our appraisal value. We demand a wide margin of safety to minimize the risk of permanent capital loss and maximize return potential, as illustrated in the example below.

Margin of Safety Example: Purchase business at $24/share with an appraisal value of $40/share (60% P/V)

This illustration does not reflect performance of any particular security. Actual investment performance and returns are not guaranteed. “Margin of Safety” is a reference to the difference between a stock’s market price and Southeastern’s calculated appraisal value. It is not a guarantee of investment performance or returns. The P/V ratio represents a single data point and should not be construed as something more. P/V does not guarantee future results, and we caution investors not to give this calculation undue weight.

Components of 1-year Compounded Annual Return

Value growth driven by strong business moat and skilled management

12%

Value growth driven by strong business moat and skilled management

12%

Total Return24%

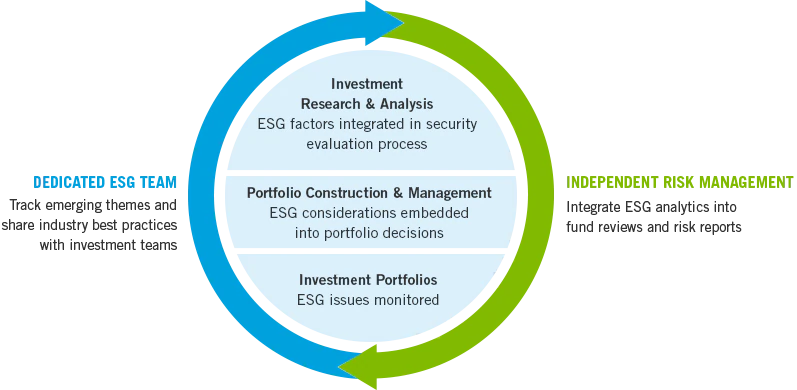

We embed ESG best practices and analytics in our investment processes, enhancing our traditional financial analysis – to open new investment opportunities, help manage risk and seek to enhance returns over the long term.

include ESG considerations in research and stewardship activities

include ESG considerations in research and stewardship activities

include ESG considerations in research and stewardship activities

Diligent stewardship helps us to safeguard clients’ investments and unlock value. Our portfolio managers and analysts engage with executives and board members of the organizations we invest in to review issues we believe are material to their firms’ long-term prospects.

We also meet and collaborate with industry bodies, non-governmental organizations, academics and other specialists that could provide valuable insights.

We take our proxy voting responsibility seriously and are committed to voting in the best interests of our clients.

Including or excluding certain investments to meet specific criteria to suit clients' beliefs, such as religious or ethical values.

Positioning towards issuers with leading ESG practices or actively engaging with underperformers by these standards.

Targeting issuers that address social/environmental challenges via their products and services.

Investing with the explicit intention to generate positive and measurable social and environmental outcomes.

Our commitment to Responsible Investment is supported by collaborating with organizations that promote and establish best practice.

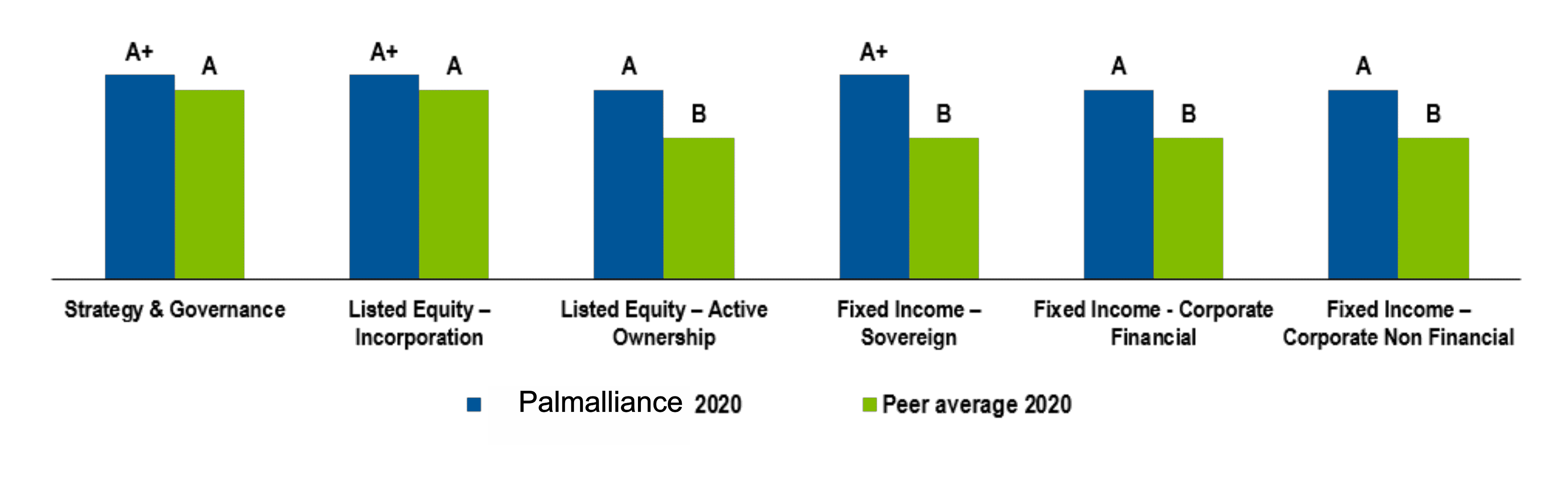

Commsec Assets Resources has been a signatory of the Principles for Responsible Investment (PRI) since April 2013, ranking ahead of the peer median score in all categories in 2020.